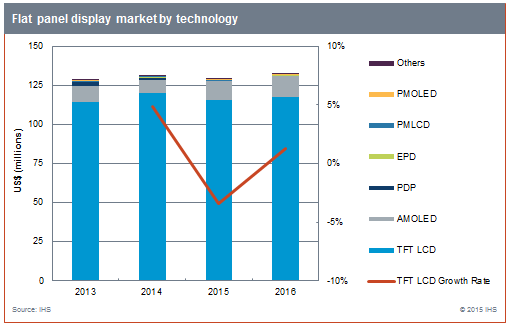

Flat Panel Display Revenues Forecast to Fall in 2015, IHS Says

SANTA CLARA, Calif. — Led by declining thin-film-transistor liquid-crystal display (TFT LCD) revenues, global flat panel display (FPD) industry revenue is forecast to fall 2 percent, from $131.4 billion in 2014 to $129 billion in 2015. Dwindling TFT LCD display revenues, declining panel demand in the PC sector, along with ongoing panel-price erosion are the primary reasons for overall FPD revenue declines this year, according to IHS Inc. (NYSE: IHS), the leading global source of critical information and insight.

After growth last year, global TFT LCD display revenue is expected to decline 3 percent, from $120 billion in 2014 to $115.8 billion this year. However, IHS expects a return to TFT LCD market revenue growth in 2016. Plasma, cathode-ray tube (CRT), passive-matrix liquid crystal display (LCD) and electronic paper display (EPD) are also facing revenue declines, as some technologies become obsolete and others lack new applications. Organic light-emitting diode (OLED) is the only display technology expected to grow in 2015, according to the latest IHS Display Long-Term Demand Forecast Tracker.

TFT LCD display revenues grew 5 percent last year, from $114.4 billion to $120 billion, due mainly to strong growth in LCD TV panel shipments and higher panel prices. However this year the TFT LCD market is expected to decline for the following reasons:

Even as revenues decline in 2015, area demand for TFT LCD is still expected to grow nearly 4 percent, from 165.5 million square meters in 2014 to 172 million square meters in 2015. This shows that the revenue decline is being driven by average selling price (ASP) erosion.

“Panel prices are eroding for several reasons, including the swing in LCD TV panel inventory from limited supply to over-supply, which began in the second quarter of this year,” said David Hsieh, senior director of display research for IHS. “Other reasons include falling demand in the PC sector, and panel-capacity expansion pressure on smartphone displays, especially in LTPS panels. The entire FPD supply chain now must shift focus from growth to cost reduction, in order to maintain profitability.”

Active-matrix OLED (AMOLED) display revenues are projected to reach $11.8 billion in 2015, up 36 percent from 2014. Passive-matrix OLED (PMOLED) revenues are projected to reach $450 million this year, up 22 percent from last year.

“AMOLED growth is based on several factors, including soaring smartphone OLED display shipments, growth in OLED TV panel shipments, the expansion of OLED into tablet PCs and increased use in wearable devices, like Apple Watch. Flexible OLED is a key feature driving AMOLED revenues, especially given its higher ASP, attractive features and great value,” Hsieh said.

TFT LCD revenues in 2016 are expected to grow just over 1 percent, year over year, to reach $117.4 billion. The main reasons for the growth are further expansion of LCD TV features, such as larger display size, wider color gamut and further penetration of 4K UHD TV. These features will keep ASP rising; meanwhile, the emergence of the 4K displays for tablets, smartphones and desktop monitors will further increase ASP. Newer automotive displays, smart watches, public displays and other new applications will also add to TFT LCD revenue growth in 2016.

The IHS Display Long-Term Demand Forecast Tracker covers worldwide shipments and forecasts for all major FPD applications, including information from more than 140 FPD producers, covering more than ten countries.