Pay TV Providers Embrace Over-the-Top Video and ‘Skinny’ Bundles to Stave Off Cord-Cutting: IHS Infonetics Report

CAMPBELL, CA — The global pay TV services market, including cable TV, satellite TV, telco TV and over-the-top (OTT) video, totaled $237 billion in 2014, up 7 percent from the previous year, according to the 2015 IHS Infonetics Pay TV Services and Subscribers report from IHS (NYSE: IHS).

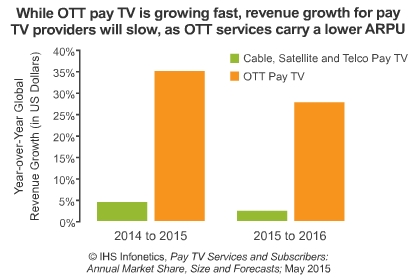

“In a growing number of pay TV markets, service providers are expanding market presence by offering their own OTT video services, primarily as apps on tablets and third-party OTT media servers. Dish Networks, the second-largest satellite provider in the US, is offering an OTT video service called Sling TV that’s aimed squarely at cord-cutters and cord-nevers,” said Jeff Heynen, research director for broadband access and pay TV at IHS. “The net result of these offerings will be slower revenue growth globally as OTT services carry a lower ARPU.”

“Pay TV providers are also actively marketing ‘skinny’ bundles of 10 to 30 channels in more affordable packages. Verizon has gone so far as to introduce multiple bundles of channels that subscribers can add on top of their base channels to create a custom channel lineup,” Heynen said.

PAY TV MARKET HIGHLIGHTS

Global pay TV subscribers ballooned to nearly 800 million in 2014 (up 5 percent); for the first time, the OTT pay TV segment provided the strongest growth.

Over the 5 years from 2014 to 2019, OTT pay TV services are forecast by IHS to have the highest compound annual growth rate (CAGR) of any pay TV service.

Cable pay TV revenue growth slowed to 1.8 percent in 2014, largely due to sluggish subscriber growth in North America, where net video subscribers are declining around 1 to 3 percent annually.

VIDEO SERVICES REPORT SYNOPSIS

The 2015 IHS Infonetics pay TV services and subscribers report provides worldwide and regional market share, market size, forecasts through 2019, analysis and trends for telco, cable (analog, digital), satellite and OTT pay TV service revenue, ARPU and subscribers. Pay TV providers tracked include AT&T, Beijing Gehua, BCE (Bell Canada), British Sky Broadcasting, Cablevision, CanalSat, Charter, China Telecom, Comcast, Cox, DirecTV, DISH Network, J:COM, Jiangsu Cable, Kabel Deutschland, Netflix, Orange, Shaw, Sky Italia, Tata Sky, Time Warner Cable, UPC Broadband, Verizon, Virgin Media and many others.