Naspers has reported an increase of 342,000 households across its African pay-TV business in the first half.

The company, which operates under the MultiChoice brand, now has services available in 873,000 households. Around 1.2 million subscribers have a PVR.

The segment reported a revenue increase of 18% year over year to reach R20.2 billion and delivering a profit of R5 billion.

MultiChoice now runs DTT services in 11 countries and Naspers in now looking towards further analogue switch offs to further grow the business.

“The second half of the year is traditionally the most active part of the year for most of our businesses. We expect some pick-up in spend as we capitalise on the holiday season, which could result in lower core headline earnings for that period,” cautioned CFO, Basil Sgourdos. “Our goal remains to develop online classifieds, etail and DTT to deliver future growth and create value over time,” he added.

Local content hubs are being developed in Nigeria and Kenya; and additional transponder capacity has recently been purchased from Eutelsat and Intelsat.

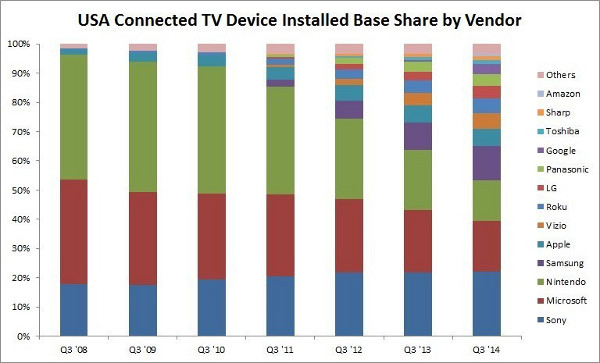

Sony led the US IP Games Console market for the third consecutive quarter capturing just under 50 percent of unit shipments in Q3. Microsoft claims the largest installed base of all three console vendors though with close to 30 million Xbox’s in use in the country.

Sony led the US IP Games Console market for the third consecutive quarter capturing just under 50 percent of unit shipments in Q3. Microsoft claims the largest installed base of all three console vendors though with close to 30 million Xbox’s in use in the country.